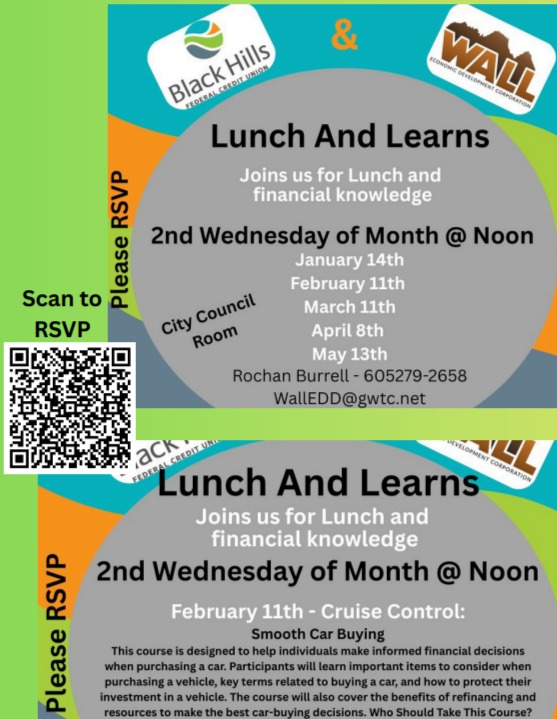

Upcoming Lunch and Learn Classes

14 Jan 2026

Newsletter

January 14th - Think Twice:

Outsmarting Fraudsters & protecting your financial Well-Being

Fraud is becoming more sophisticated, with scammers constantly evolving their tactics to steal personal and financial information. This interactive course will empower you with the knowledge and tools to identify, prevent, and respond to fraud effectively. You'll explore the most common types of fraud—identity theft, social engineering scams, and investment scams—while learning practical strategies to protect your finances. We'll also highlight the fraud prevention resources available through BHFCU and GreenPath, including financial counseling, credit monitoring, and secure banking solutions. By the end of this course, you’ll be equipped with the confidence and skills to safeguard your personal and financial information and take proactive steps to stay ahead of fraudsters.

February 11th - Cruise Control:

Smooth Car Buying

This course is designed to help individuals make informed financial decisions when purchasing a car. Participants will learn important items to consider when purchasing a vehicle, key terms related to buying a car, and how to protect their investment in a vehicle. The course will also cover the benefits of refinancing and resources to make the best car-buying decisions. Who Should Take This Course? First-time car buyers, individuals looking to finance or refinance a car, anyone seeking to save money on a car purchase.

March 11th - Impulse and Influence:

The Hidden Forces Behind Your Purchases

Why do we spend the way we do? Our financial decisions are often influenced by emotions, social pressures, and subconscious triggers rather than logic alone. Impulse and Influence: The Hidden forces Behind Your Purchases explores the fascinating science behind our spending behaviors, revealing how cognitive biases, marketing tactics, and digital conveniences shape our financial choices.

In this engaging and interactive course, you'll learn to identify the psychological and emotional factors that drive spending, recognize common pitfalls like impulse buying and retail therapy, and discover practical strategies for making more intentional and financially sound decisions. Through real-world examples, self-reflection exercises, and actionable insights, you’ll gain the tools to break bad habits, set meaningful financial goals, and take control of your money with confidence. Whether you’re looking to improve your personal finances, gain insight into consumer behavior, or simply make smarter financial choices, this course will provide you with valuable knowledge and tools to rethink your relationship with money.

April 8th - Understanding Credit & Credit Cards

Managing Credit Wisely

Cards managing credit wisely is essential for financial success. This interactive course provides a comprehensive guide to credit and credit cards, covering key topics such as credit scores, credit reports, responsible credit use, and common pitfalls to avoid. By the end of this course, attendees will have practical knowledge and strategies to build and maintain good credit. Additionally, they will learn about the financial wellness resources available through BHFCU and GreenPath. Whether you're new to credit or looking to improve your financial habits, this course will equip you with the tools to make informed credit decisions.

May 13th - Master Your Money:

Budgeting for Success!

Managing your finances effectively starts with a solid budget. This course provides a comprehensive guide to understanding, creating, and maintaining a budget that aligns with your financial goals. You will learn about different budgeting methods, strategies for tracking expenses, tips for cutting costs, and ways to stay on track for long-term financial stability. Through interactive elements, real-world applications, and expert insights, this course will empower you to take control of your financial future. Whether you're looking to save more, pay off debt, or simply manage your money better, this course will provide the tools and knowledge needed to succeed.

More Topics

.png)

.png)

.png)